"For Japan, Italy will be the new Spain, Spain will be the new France, and France will be the new Italy."

Global duration positioning of Japanese investors: turning more bullish on EGBs (ex-France)?

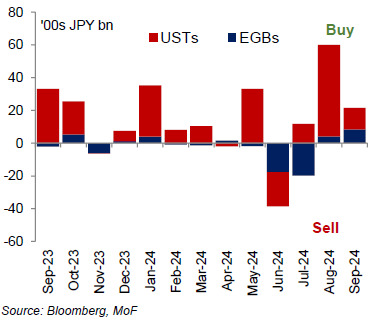

We are seeing a shift in the way Japanese investors are thinking about global fixed income and EGBs. Japanese investors were spooked out of overseas long-term sovereign bonds in 2022 as G3 central banks delivered an aggressive hiking cycle. Following that global rates rout, Japanese investors only seemed to like USTs in FY23. Buying of EGBs was minimal and focused on OATs. Latest data from the MoF suggests that some trends are changing.

Firstly, we are starting to see a reduction in UST buying, while buying of (most) EGBs has picked up. This has been one of the key stories that the September MoF data tells. This move can be attributed to position-squaring in USTs ahead of the US election and increasingly attractive yields on EGBs (we’ll cover this point below). We suspect Japanese investors will start to be concerned about inflationary and issuance pressures in USTs.

September: USTs becoming less popular and largest buying of EGBs in the last year

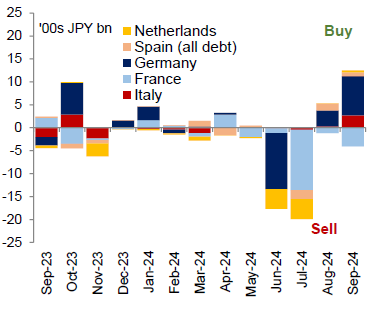

September: more BTPs please!

Secondly, we are observing a shift in the way Japanese investors are thinking about EGBs. Looking at past data, France has been one of their top choices out of the EGB space. However, since Macron called for snap elections in July, we have observed an ongoing rotation out of France and semi-core into other EGBs including Italy. As we will highlight below, FX-hedged yields for BTPs look very attractive and we expect this to improve significantly in coming months. The rotation out of France and into Italy will continue.

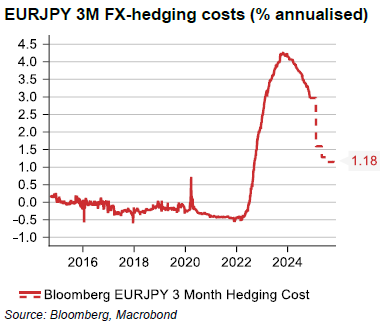

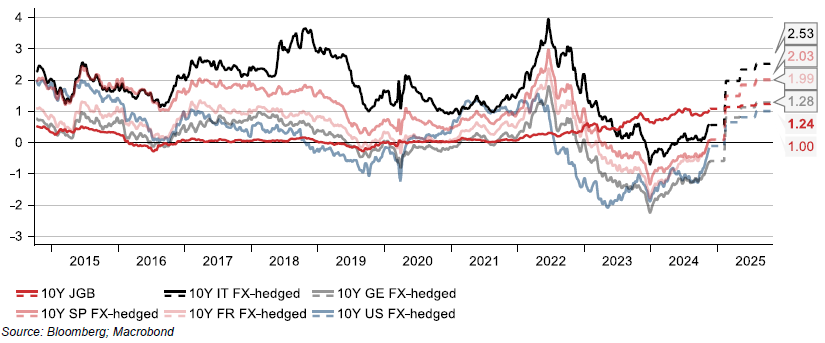

JP investors attitude towards EUR duration: EGB yields look increasingly attractive on an FX-hedged basis

Higher hedging costs have made most overseas rates products look unattractive to Japanese investors, who like to buy long-term foreign bonds with an FX hedge. However, with the ECB looking to cut policy rates while the BoJ continues with their hiking cycle, we foresee a notable decrease in EURJPY FX-hedging costs that will ultimately drive a shift in how Japanese investors look at EGBs. The below forecasts are made using current FX fwd points, but bear in mind that we hold a more dovish view on ECB (1.50% terminal) and a more hawkish view in the BoJ (1.0% terminal) vs what the market is pricing, meaning that we may see an even more pronounced decrease in 3M FX-hedging costs for Japanese investors that buy EUR (towards below 1.0% annualized).

EURJPY 3M FX-hedging costs (% annualised)

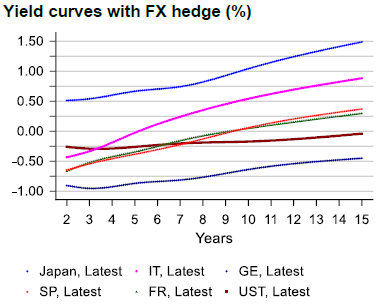

Yield curves with FX hedge (%)

How will this change in FX costs shape the all-in yields of FX-hedged EGBs? 10Y FX-hedged BTPs are currently yielding around a 0.50% annualized yield, which looks low compared to the 1.05-1.10% yield that 10Y JGBs provide. However, our forecasts show that 10Y BTPs may soon start to have a higher yield than JGBs, rising to 2.50% (with FX-hedge!) in the next year. Meanwhile, 10Y JGBs are unlikely to move much further above 1.30% in the next 3-6 months. Given the fundamentals in Italy (more on this coming up), this means that we should see ongoing buying of BTPs from Japan.

10Y FX-hedged yields to JPY vs 10Y JGB (%, 7-day moving average)

What about XCCY as the FX hedge? If we compare where sovereign ASWs trade when swapped to TONAR (see Appendix 1), we see that BTPs continue to provide the best pick-up in the sovereign rate space at TONAR + 81bp for the 10Y BTP. 10Y JGB ASW trades at TONAR + 1.9bp.

The credit landscape has changed: BTPs are now a rates product, France is unstable, and Spain is too rich

The attractiveness of BTPs within the rest of the EGB complex doesn’t come only from market valuations, but also from fundamentals.

On growth, barring the Olympics-driven push in France, Italy continues to outperform alongside Spain (see PMIs in the Appendix 2). Italian GDP growth is expected to pick-up in coming years, driven mainly by domestic demand. The Italian economy enjoys a very positive mix of low inflation and unemployment rates (see Phillips curve in the Appendix 2), which should continue to support consumption. This is particularly relevant for an economy that is as service oriented as Italy (73% of real GDP is driven by the services sector).

Lower ECB policy rates should also support the Italian economy and avoid any unnecessary rise in unemployment. Against this backdrop we have 1) Spain, where floods will likely put pressure on the near-term economic growth at a time when market valuations look expensive; 2) Germany, who is undergoing a structural and cyclical downturn with no end in sight; and 3) France, where growth also remains depressed and political turmoil clouds any government-related push.

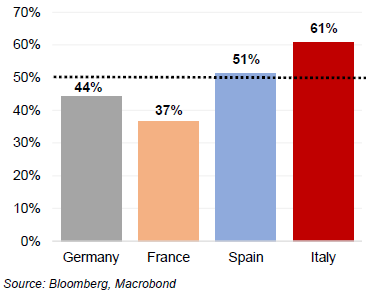

On the political front, Italy is also outperforming. The Italian government is currently the most stable out of the GE/FR/SP pack, with governing parties making up 61% of the Parliament. On the budget and fiscal policy, Italy has been working on reducing their debt burden following the EC’s EDP. Success relies on achieving above-estimate growth, which includes implementing the Recovery fund in a timely manner and ensuring stable macro conditions.

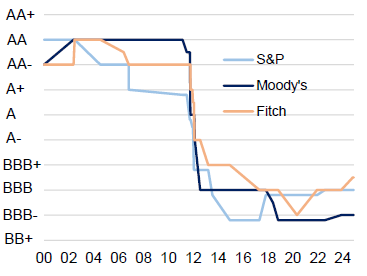

The main risk we see for the Italian economy comes from Trump’s policies. According to 2023 figures, Italy exports around 10.7% of their total exports to the US (vs 9.4% for Germany, 8.3% for France, and 5.6% for Spain). Even with this risk on the table, we think conditions are pointing to a catch-up of Moody’s (22nd Nov) with the other rating agencies and a change in their Italian long-term debt outlook to Baa3 positive. Italy has shown some evidence of getting round the political challenges and the commitment to consolidate their debt may be enough to secure a better outlook, which is also in line with how optimistic markets are on Italy.

Government majority as % of Parliament

Italian rating history

What about locals? European investors will likely load up on BTPs in 2025

Local European investors will likely be cautious in the next few months due to three key themes: 1) next year’s supply; 2) the tightening seen in EGB spreads YTD; and 3) political uncertainty in Germany and France.

On supply, there will be a lot of issuance coming next year (expectations are north of €1.0tn in EGBs and $1.9bn in USTs). This will prevent any sustained richening of EGBs on ASW in the very short term. As such, real-money investors like Bank Treasuries will be discouraged to add before the January supply in a year when positions are likely under water due to the recent EUR swap spread move.

Then we have the political turmoil in France and Germany, which has driven an increase in vol. We suspect investors will prefer to see some stability before entering in.

Lastly, we note that the EGB spread tightening theme has gone a long way in 2024, especially in BTPs and SPGBs. Even though we expect further beta-tightening to happen, we think some investors (fast-money) will not see current technical levels and profitability as attractive to go long.