Responsible financing and investment

Mizuho has established a management framework for responsible financing and investment, and is working to ensure environmental consideration and respect for human rights in its financing and investment activities.

An overview of responsible financing and investment

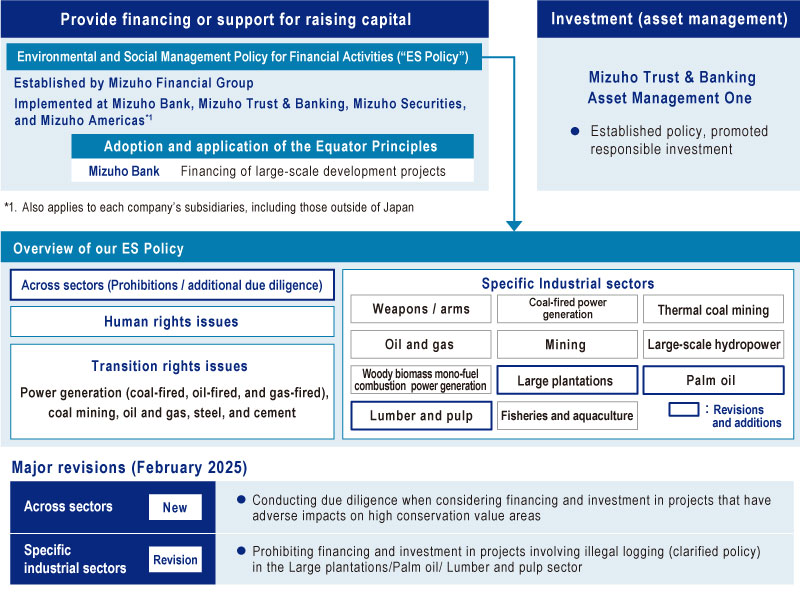

Mizuho has established the Environmental and Social Management Policy for Financial Activities ("ES Policy"), which covers responses to climate change, conservation of biodiversity, and respect for human rights, to prevent and mitigate adverse impacts of financing and investment on the environment and society.

In February 2025, we revised the ES Policy to strengthen our responses to issues such as loss of nature.

Overview of our Environmental and Social Management Policy for Financial Activities (PDF/719KB)

Implementation of Environmental and Social Management Policy for Financial Activities

| Verification process when screening a potential transaction |

|

| Verification process during the transaction term |

– Verify the degree to which clients have taken steps to avoid or mitigate environmental and social risks. – With clients in transition risk sectors, discuss medium- to long-term issues and confirm the status of the client’s response in regard to climate change risks and opportunities.

|

| Governance |

|

| Education and training |

|

| Stakeholder communication |

|

Providing financing or support for raising capital

As a global financial institution, Mizuho is committed to meeting the banking needs of the communities in Japan and around the world where we operate. To deliver on our responsibilities as a bank, and to contribute to the sound development of economies and societies, we draws on our sophisticated risk–taking capabilities structured within a firm risk management framework.

Additionally, Mizuho’s Credit Code, which stipulates our basic approach, guidelines, and lending criteria, emphasizes the importance of utilizing the provision of credit as a means of contributing to the sustainable development of the economy and society as well as solving social issues. In fact, one of the lending criteria in this Code is whether the extension of credit will contribute to the sound development of the economy and the communities we serve.

We make credit decisions after examining the recognized risks based on our Environmental and Social Management Policy for Financial Activities, and we also engage in dialogue with customers regarding medium– to long–term environmental and social issues.

Similarly to our credit operations, in our trust operations as well we make decisions on securitization of real estate and other affairs after examining the recognized risks based on our Environmental and Social Management Policy for Financial Activities. In this way, we are ensuring thorough responses to environmental and social issues.

We also seek to take environmental and social impact into consideration and manage risk through the following initiatives.

The Equator Principles

We recognize that large–scale development projects may have adverse impacts on the environment and local communities. To minimize and/or mitigate the environmental and social risks associated with such large–scale developments, Mizuho Bank works together with the project proponents (clients) to conduct appropriate environmental and social risk assessment/due diligence as required under the Equator Principles*. The Equator Principles was most recently revised to the fourth version (EP4) following consultation with various stakeholders and financial institutions led by the Equator Principles Association of which Mizuho Bank was the Asia Oceania Regional Representative. Mizuho Bank started to apply the EP4 from July 2020.

* The Equator Principles are a set of voluntary guidelines adopted by financial institutions to ensure that large–scale development or construction projects appropriately consider the associated potential impacts on the natural environment and the affected communities.

Assessments of environmental risk related to real estate collateral

To deal with environmental risk in real estate, including pollution of the soil, usage of asbestos, and other issues related to real estate collateral, we implement assessments of environmental risk when certain established conditions apply. When risks are judged to be above a specified level, the amount corresponding to the assessed risk is deducted.

Investment (asset management)

Mizuho believes that giving appropriate consideration to environmental, social, and corporate governance (ESG) issues and other aspects through responsible investment initiatives to improve and foster investee companies' sustainability and enterprise value will enhance the medium– to long–term investment return for our customers, and furthermore contribute to the flow of funds supporting the development of a sustainable society.

Mizuho's trust banking arm, Mizuho Trust & Banking, and Asset Management One have established the following policy and are working to promote responsible investment initiatives.

Asset Management One’s Sustainable Investment Policy (Japanese text only)

Mizuho Trust & Banking and Asset Management One are taking initiatives to implement stewardship responsibilities and promote ESG investing by adopting and setting policies to put into practice Japan's "Principles for Responsible Institutional Investors (Japan's Stewardship Code)." Mizuho believes these activities are important for fulfilling our proper role as a responsible institutional investor.

Asset Management One's Policies with Respect to Japan's Stewardship Code (Japanese text only)

In addition, these two entities have signed on to the UN Principles for Responsible Investment (PRI), which ensure that institutional investors and pension funds, etc., incorporate environmental, social, and corporate governance (ESG) considerations into their decision–making processes.

Mizuho Trust & Banking and Asset Management One are also strengthening their ESG investment initiatives by incorporating ESG–related issues and engagement into their investment strategies and giving consideration to ESG issues in exercising their proxy voting rights.

Initiatives for responsible investment

Details of Mizuho Trust & Banking's activities towards responsible investment. (Japanese text only)

Stewardship activities

2024 Asset Management One Sustainability Report

Details of Asset Management One's stewardship activities and Sustainability Reports.